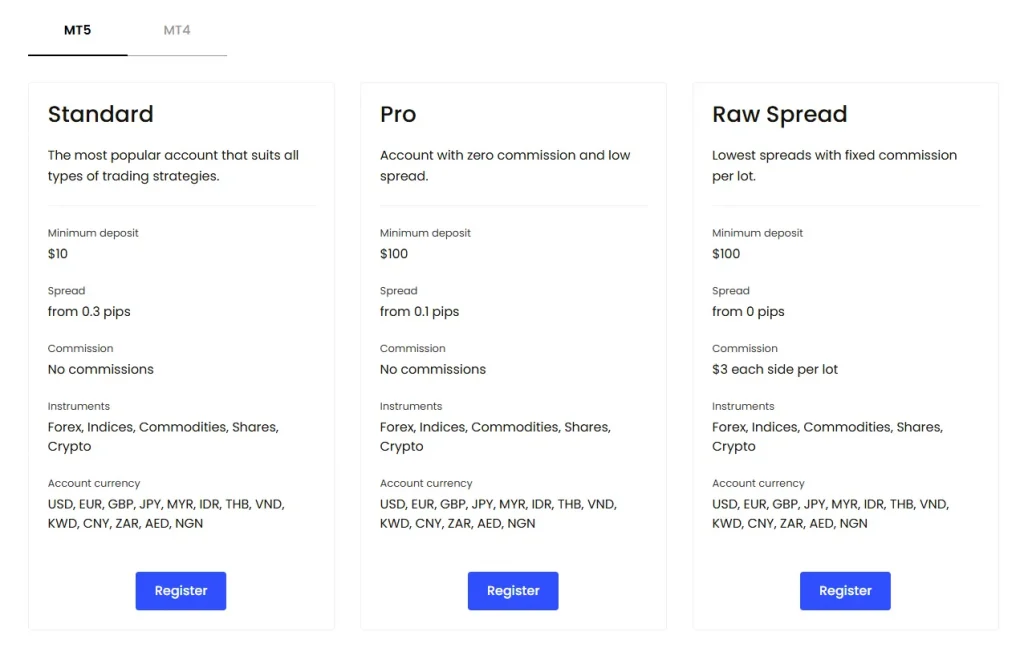

Minimum deposit JustMarkets

Minimum Deposit Requirements

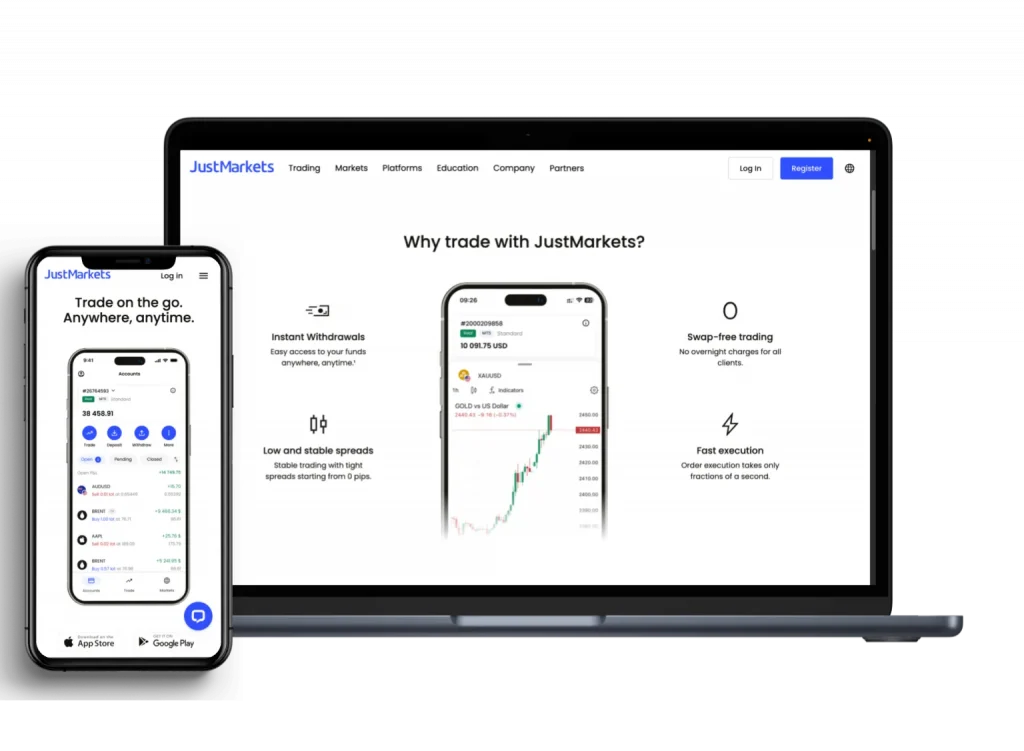

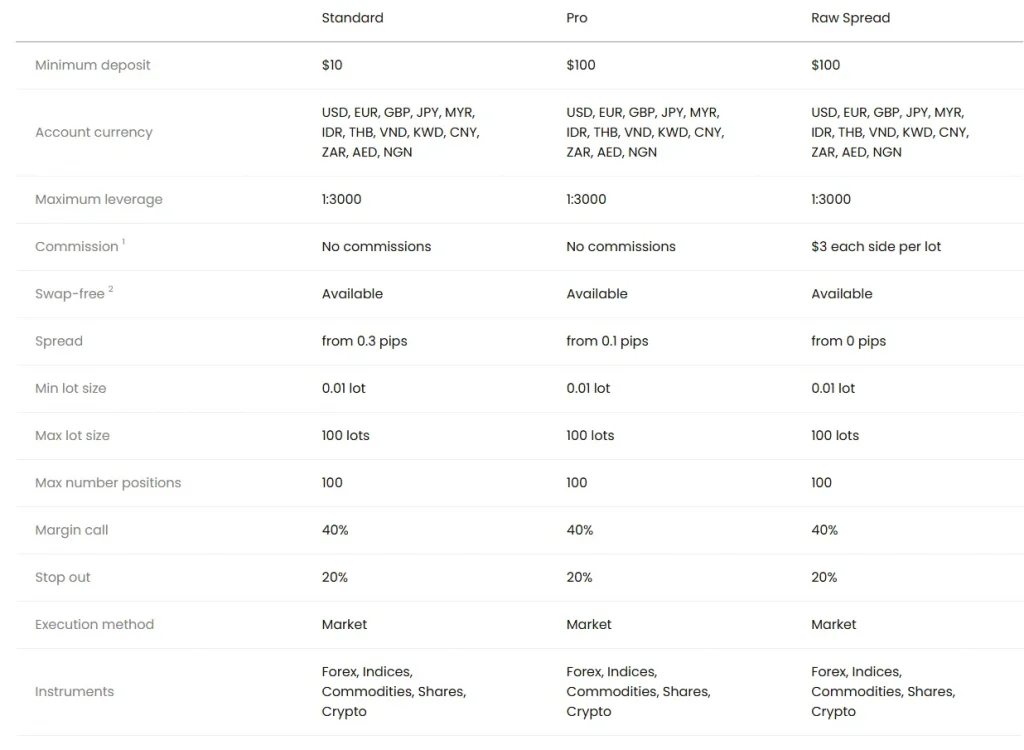

The account structure includes additional customization options based on trading volume and experience level. Platform integration enables seamless transition between account types through deposit adjustments. Market access parameters adapt automatically to deposit levels ensuring optimal trading conditions.

Advanced monitoring systems track deposit utilization and trading patterns. Account optimization includes automated suggestions for feature enhancement. Support teams provide personalized guidance for deposit allocation and account selection.

Account Deposit Levels

Account Type | Minimum Deposit | Trading Features |

Standard | $10 | Basic trading |

Pro | $100 | Advanced features |

Raw Spread | $100 | Professional tools |

Payment Methods Available

Payment infrastructure incorporates advanced security protocols while maintaining processing efficiency. Integration systems enable seamless transitions between payment methods. Method selection includes automated optimization based on location and preferences.

Transaction routing ensures optimal processing paths for each method. Support systems provide real-time assistance with method selection and processing. Regular updates maintain current payment technology standards.

Processing Specifications

- International Transfers

- SWIFT processing

- Wire transfer options

- International banking networks

- Currency conversion services

- Local Methods

- Regional bank integration

- Mobile payment systems

- Local transfer networks

- Branch deposit options

- Electronic Solutions

- Digital wallet processing

- Online payment systems

- Mobile application integration

- Instant transfer networks

Deposit Processing Procedures

Deposit procedures follow systematic protocols ensuring security and efficiency. Processing includes automatic verification and account crediting. System monitoring maintains transaction security throughout the process.

Support teams provide assistance with deposit-related inquiries. Processing times vary by payment method and verification requirements. Documentation provides detailed information about processing procedures.

Processing Times

Method | Processing Time | Availability |

Cards | Instant | 24/7 |

Bank Transfer | 1-3 days | Business days |

E-wallets | Instant | 24/7 |

Account Verification Requirements

Account verification follows standard KYC procedures before initial deposit. Document requirements include identity verification and proof of residence. Verification processing occurs through secure channels with regular status updates.

Support teams assist with verification-related inquiries. Processing times maintain efficiency while ensuring compliance. System automation enables rapid verification completion.

Required Documents

- Government-issued ID

- Proof of residence

- Bank statement

- Additional documentation if required

Currency Conversion Options

Currency conversion services accommodate various deposit currencies. Conversion rates follow market conditions with transparent pricing. System processing includes automatic rate calculations.

Conversion documentation provides detailed transaction information. Support teams assist with currency-related inquiries. Processing includes regular rate updates.

Available Currencies

Base Currency | Conversion Available | Processing |

ZAR | Yes | Real-time |

USD | Direct | Immediate |

EUR | Yes | Real-time |

Deposit Security Measures

Security protocols protect all deposit transactions through multiple layers. System monitoring detects and prevents unauthorized transactions. Verification procedures ensure transaction legitimacy.

Security updates maintain current protection standards. Support teams respond to security-related inquiries. Documentation provides detailed security information.

Security Features

- SSL encryption

- Transaction monitoring

- Verification protocols

- Fraud prevention

- Account protection

- System alerts

Account Funding Limitations

Account funding follows specific limitations based on verification level. Transaction limits maintain compliance with regulatory requirements. System monitoring ensures adherence to established limits.

Support teams provide guidance regarding funding limitations. Documentation includes detailed limit information. Regular updates maintain current limitation standards.

Deposit Confirmation Process

Confirmation procedures provide transaction verification through multiple channels. System notifications include detailed transaction information. Documentation maintains comprehensive record keeping.

Support teams assist with confirmation-related inquiries. Processing includes automatic status updates. Confirmation records remain accessible through account systems.

Additional Account Features

Account features vary based on deposit level and account type. Platform access includes standard trading tools and analysis capabilities. Support services maintain consistent availability across all account levels.

Feature activation occurs automatically upon deposit completion. System updates maintain current functionality. Documentation provides detailed feature information.

Frequently Asked Questions

Most electronic payments process instantly, while bank transfers may take 1-3 business days depending on the method and verification requirements.

Yes, deposits in ZAR are accepted and automatically converted at current market rates.

Deposits below the minimum requirement will be rejected automatically. Contact support for assistance with proper deposit procedures.